Introduction of family allowances

Family allowances (CAF) in Switzerland vary from canton to canton and can be complex to manage. This article will guide you through the configuration of family allowances in Odoo V17, to ensure that your payroll is compliant with cantonal and federal laws.

Configuration of family allowances

To configure family allowances, go to Pay >> Configuration >> Family allowances (CAF)

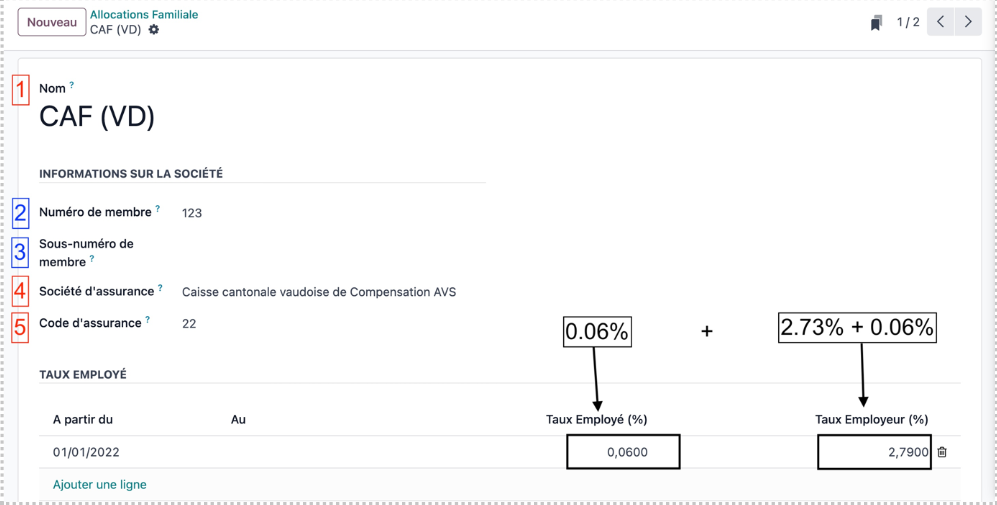

Create your new allocation, fill in the mandatory and optional fields. Below is an example of family allowances in the canton of Vaud (incl. PC fam.)

![]() Practical tips

Practical tips ![]()

The configuration of a cantonal contribution (e.g. PC famille - VD) does not yet follow the Swissdec logic. Although the recipient institution is the same in the case above (cantonal fund), the PC family contribution should be in the category "other cantonal contributions". The alternative used until correction by Odoo V17, and to include it with the AF, as shown in figure 13, and adapt the labels accordingly. To adjust the label, go to Configuration >> Rules and then look for the "CAF" rule. Rename it as desired on the payslip.

Conclusion

The correct configuration of family allowances in Odoo V17 ensures that salary calculations are automatic and compliant, thus reducing errors and processing time.

For more information, ask for the Nalios Pay module configuration guide! And to go further, do not hesitate to view our tutorial on YouTube by clicking here