Configuration of social contributions: AVS/AI/APG & AC

The management of social security contributions is an integral part of payroll in Switzerland. Odoo V17 allows you to configure these contributions precisely, thus simplifying compliance with local regulations. In this article, we will detail the configuration of AVS/AI/APG and CA in Odoo V17.

Configuration steps

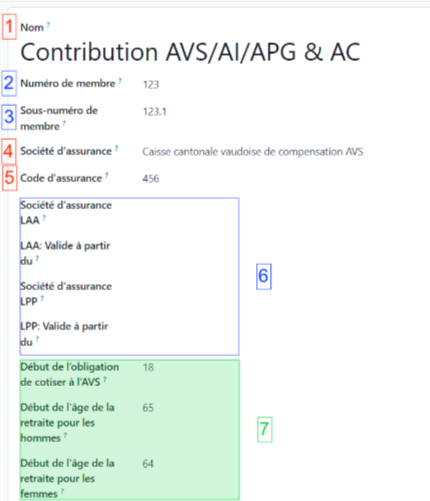

To configure the AVS/AI/APG, as well as the CA, you must go to (Pay >> Configuration >> AVS/AC insurance). From there, you can define:

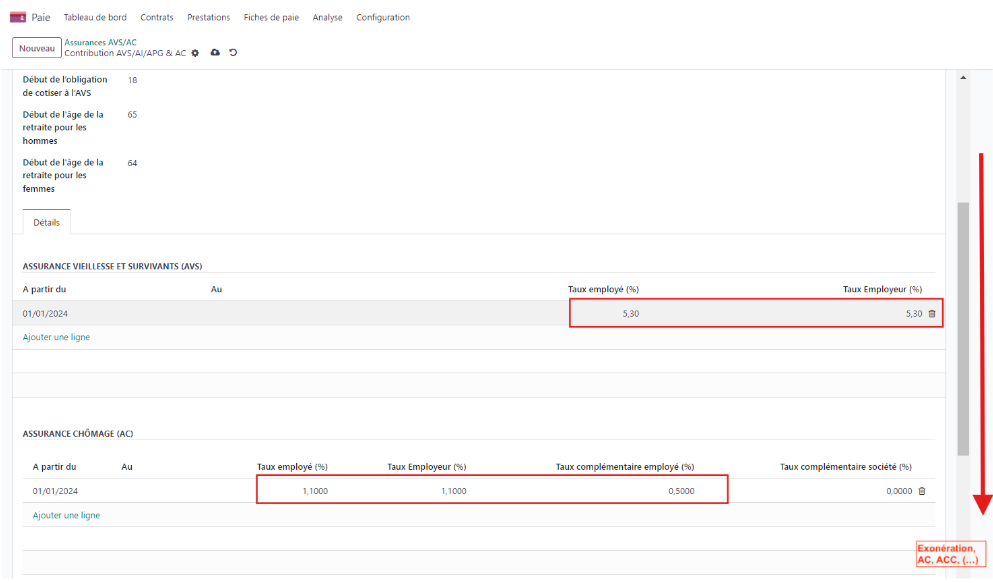

Contribution rate & AVS/AI/APG maturity (on the AVS table)

The CA contribution rate & maturity

The AVS/CA exemption

The AC threshold

On this first image, we see the mandatory and optional information to provide.

Once all this information is completed, complete:

From: start date

At: end date (useful to indicate a change, in this case add a new line with new deadlines)

Rate employed (%) & employer rate(%): Odoo V17 automatically completes these rates with the current rates (exception AC rate complementary)

Amount: Odoo V17 automatically supplements these amounts according to the thresholds and deductibles in force.

Practical Tips

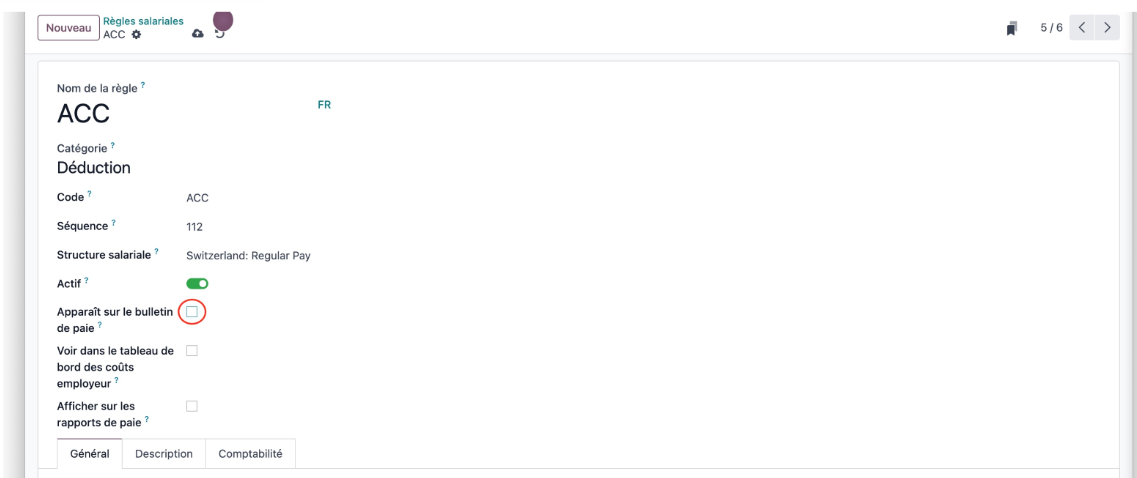

the ACC (the supplementary rate), is no longer deducted since 01.01.2023 (source: admin.ch). To ensure compatibility with Swissdec, set the AC supplementary rate to 0% (employee and company). Then hide the rule from the payroll (Configuration >> Rules), looking for the " ACC "rule.

The ACC threshold must also be completed with the automatically populated threshold.

For more information, ask for the Nalios Pay module configuration guide! And to go further, do not hesitate to view our tutorial on YouTube by clicking here