Inleiding

Gezinstoelagen (CAF) in Zwitserland variëren van kanton tot kanton en kunnen complex zijn om te beheren. Dit artikel leidt je door de configuratie van gezinstoelagen in Odoo V17, zodat je salarisadministratie voldoet aan de kantonnale en federale wetgeving.

Configuration of family allowances

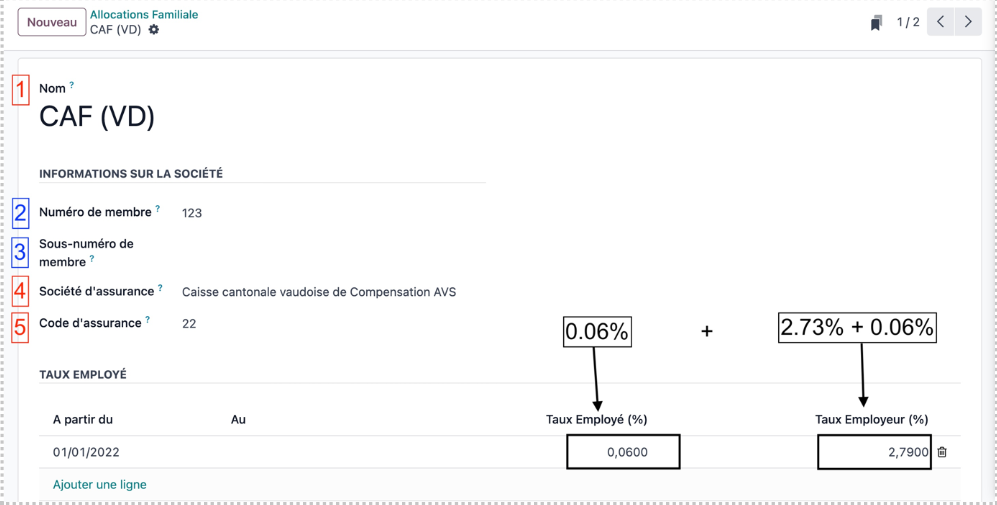

Om gezinstoelagen te configureren, ga je naar Payroll >> Configuratie >> Gezinstoelagen (CAF).

Maak uw nieuwe toewijzing aan en vul de verplichte en optionele velden in. Hieronder ziet u een voorbeeld van gezinstoelagen in het kanton Vaud (incl. PC fam.).

![]() Praktische tips

Praktische tips![]() :

:

De configuratie van een kantonnale bijdrage (bijv. PC famille - VD) volgt nog niet de Swissdec logica. Hoewel het ontvangende orgaan hetzelfde is in het bovenstaande geval (kantonfonds), moet de bijdrage van het PC gezin in de categorie “andere kantonale bijdragen” staan. Het alternatief dat tot correctie door Odoo V17 werd gebruikt, is om het op te nemen bij het AF, zoals weergegeven in figuur 13, en de labels dienovereenkomstig aan te passen. Om het label aan te passen, ga naar Configuratie >> Regels en zoek dan naar de regel “CAF”. Hernoem deze naar wens op de loonstrook.

Conclusie

De juiste configuratie van gezinstoelagen in Odoo V17 zorgt ervoor dat salarisberekeningen automatisch en volgens de regels verlopen, waardoor fouten en verwerkingstijd worden verminderd.

Vraag voor meer informatie naar de Nalios Pay module configuratiegids! En om verder te gaan, aarzel dan niet om onze tutorial op YouTube te bekijken door hier te klikken: video